Humans are a walking talking contradiction.

Recently I was posed a question as to whether an investment was a good idea or not and without knowing the investors current investment situation. As an adverse, I hate this question, because it’s impossible to answer properly.

This morning I was listening to the Masters In Business Podcast where one of the guests encapsulated my exact thoughts regarding the question my friend asked me the night before.

The quote went something like this:

“A central claim of prospect theory is that people are not consistently risk averse. Yes, they are much more sensitive to losses than to gains. But they are also risk seeking, both in their attraction to long shots and in their willingness to gamble when faced with a near-certain loss. To complicate things further, we know that people do not have a global view of their assets. They hold separate mental accounts and are much more willing to gamble from some of the accounts than others. To understand an individual’s complex attitude toward risk, we must know both the size of the loss that may destabilize them and the amount they are willing to put into play for a chance to achieve large gains.”

The interviewee went on to quote Daniel Kahneman who is most well known for his book “Thinking, Fast and Slow”

I felt this was very fitting considering what my friend had asked. It seems to me that we are affected by both loss aversion and overconfidence. When it comes to investing, we experience FOMO (fear of missing out) as well as a fear of taking part in future losses.

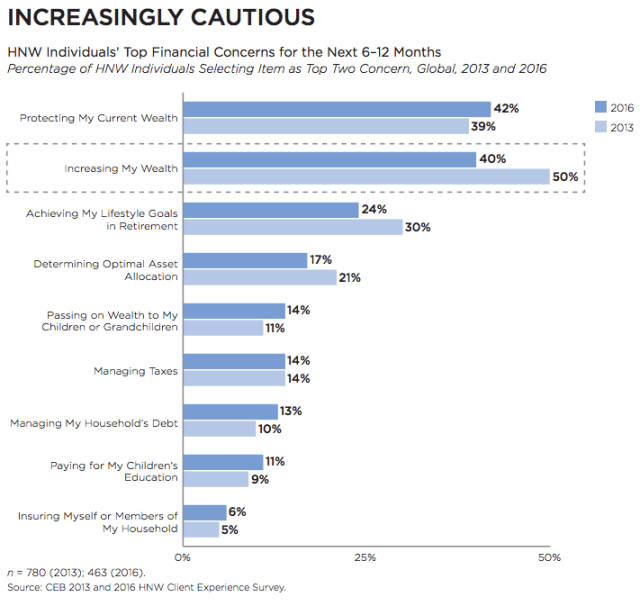

Below is a survey of high net worth individuals that shows how this conflicting mindset can affect client concerns when thinking about their investments:

At GIM, we like to say that we have a dual mandate when it comes to managing our client’s.

- Help them survive severe market disruptions in the short-to-intermediate-term.

- Help them achieve their long-term goals and desires.

The long-term is the only time frame that matters, but you must have enough liquidity and shock absorbers in your portfolio to be able to survive when markets have their inevitable downturns.

Fulfilling these two mandates is challenging. When markets are rising, people don’t worry as much about the preservation of capital. And when markets are falling, people spend all their time worrying about the preservation of capital.

Volatility can be a source of opportunity or risk, depending on your reaction to it. Turbulent markets can have a huge impact on performance, but it generally fades over time. The question is how do you make it through those tough volatile times?

Balancing a client’s appetite for risk with their capacity for risk along with their need to take risk is an ever-evolving duty for advisors. Training clients to have patience and to maintain composure through the downturns is just as important as managing their risk appetite during times of irrational exuberance.

Below are a few rules I remind myself of every day:

Never do harm. “ Anyone who has become rich twice is dumb. Why would you risk what you need and have for what you don’t need? If you are already rich, there is no upside to taking on a lot more risk, but there is disgrace on the downside.”- Warren Buffet The long-term is not where the client’s life is lived. Saving today for 40 years down the road isn’t easy and it’s a constant mental struggle.

The best advisors understand that long-term returns are the only ones that matter. But also make sure their clients understand why they will never see those returns if they don’t implement and follow a plan that gets them there.

The process of implementing a comprehensive plan involves the following:

- Setting realistic expectations

- Educating the client on what they own and why

- Clarifying and reminding people of their goals

- Making changes to the portfolio or plan when the clients lives change

- Continuous communication and,

- Acting as a behavioural counsellor to ensure no huge mistakes are made

It’s not enough to talk about the long-term, it’s our job to ensure they make it there.

If you’re interested in talking to GIM, reach out here!