1. Learn how to run your practice like a business

This is usually completely uncharted territory for anyone finishing residency. However, like most things in life, the hardest part is getting started.

There are many aspects to a medical business model that vary widely depending on your specialty and practice type. There are a number of resources that can help figure out how to build a practice that suits you and your family.

Find a Mentor – If one isn’t available, then discussing it openly with some people In your field before laying out major capital or making major commitments is advised.

Consider a locum or Joining a Established clinic

If you go this route, you should expect that there will be some type of premium paid to the practice ownership until you grow into the role of an equal partner. It may seem unfair that someone gets a better deal than you for the same work. However, remember that the clinic or established practice partners risked capital, time, and effort to build the infrastructure to where it is currently. Business risk is something you have to understand and price into your dealings.

Professional Help

Some accountants or human resource companies can help you make sure some of the details like hiring, contracts, and payroll are done correctly. These services are not usually specific to medicine.

There are some courses specific to medical practice management. The CMA has practice management seminars and downloadable resources.

2 Learn How to Bill / Get Paid

Whatever practice type you have, the majority of physicians will bill in some form. There are several aspects that go into doing this efficiently and properly

- Read your province’s schedule of benefits (fee book).

- Make a cheat sheet of frequently used codes in your specialty. (Ask a mentor or colleague).

- Speak with others in your specialty. Many of our clients have told us that they schedule a dinner with others in their specialty in order to get a feel for what everyone is up to and perhaps gain some useful insight.

- If possible, you should have someone with a vested interest in your income enter your billing. (Stat go, family, Betty etc)

3. Make A Basic Business Plan

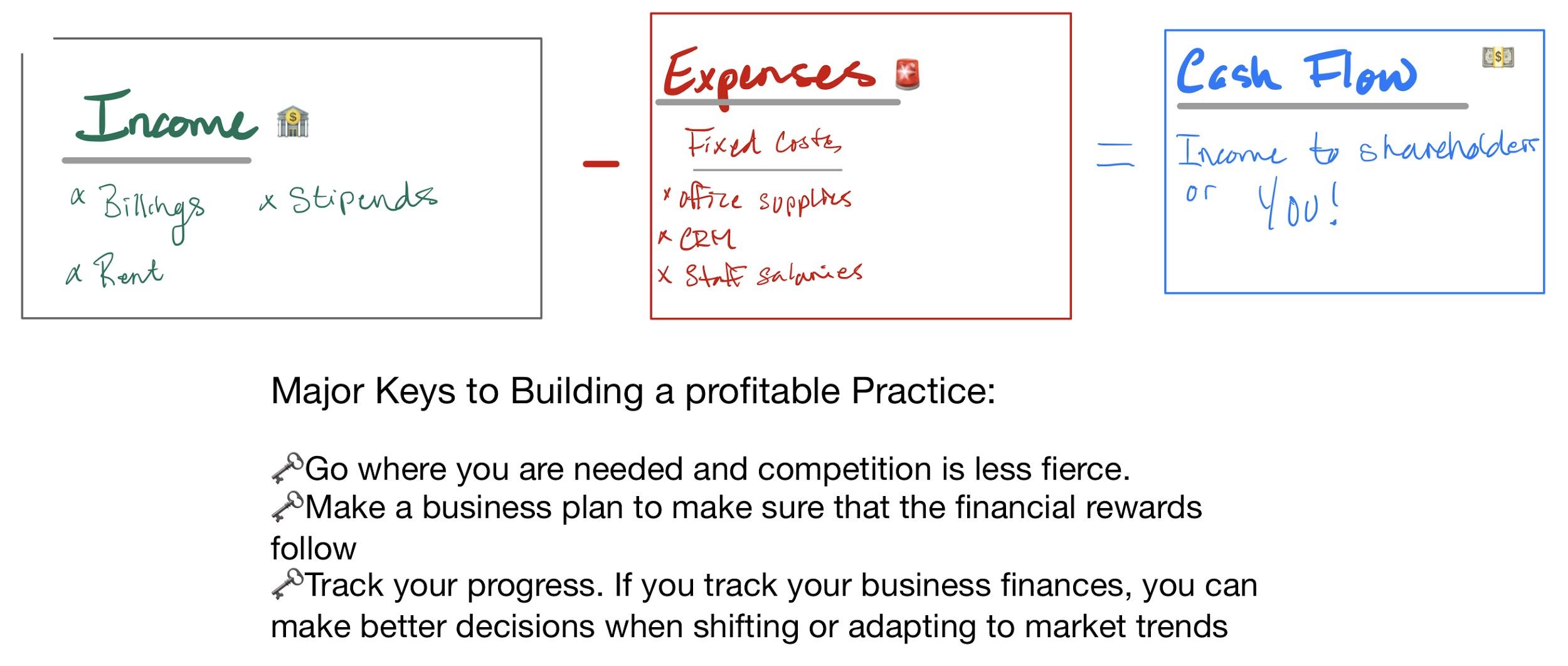

At its core, a business plan should be simple and comes down to Cash Flow = Income minus Expenses

Income: Medical practices often have a huge variety of options of what kind of work you can do. This is as basic as your Income coming in from business operations. Billings, rent, hours etc.

Expenses: Fixed costs – Like office staffing* or overhead. You need to understand these costs to plan for them. Your obligation to pay your bills continues regardless of the revenue that you are bringing in.

office space, staffing, or equipment. We recommend that our clients look at ways to share these costs with other businesses. Sometimes this involves a shared office space or a practice partner.

Incremental Costs – Keep an eye on how much revenue you generate for the incremental cost. Consider all of your expenses and write them down then simply do — income minus expenses. Make sure that this number is black and significantly so. Don’t hesitate to ask what other comparable practices margins are.

4. Find a Competent Financial Team

This is essential whether you are running your practice as a sole proprietor or have decided to incorporate.

This is a very personal process for people and shouldn’t be taken lightly. (See our guide on how to pick the right Accountant and Financial Advisor) Getting this one right has saved many huge amounts of time, anxiety, and money.

A high quality and stylish-yet-supportive-and-comfortable financial team that will discuss the best options for you.

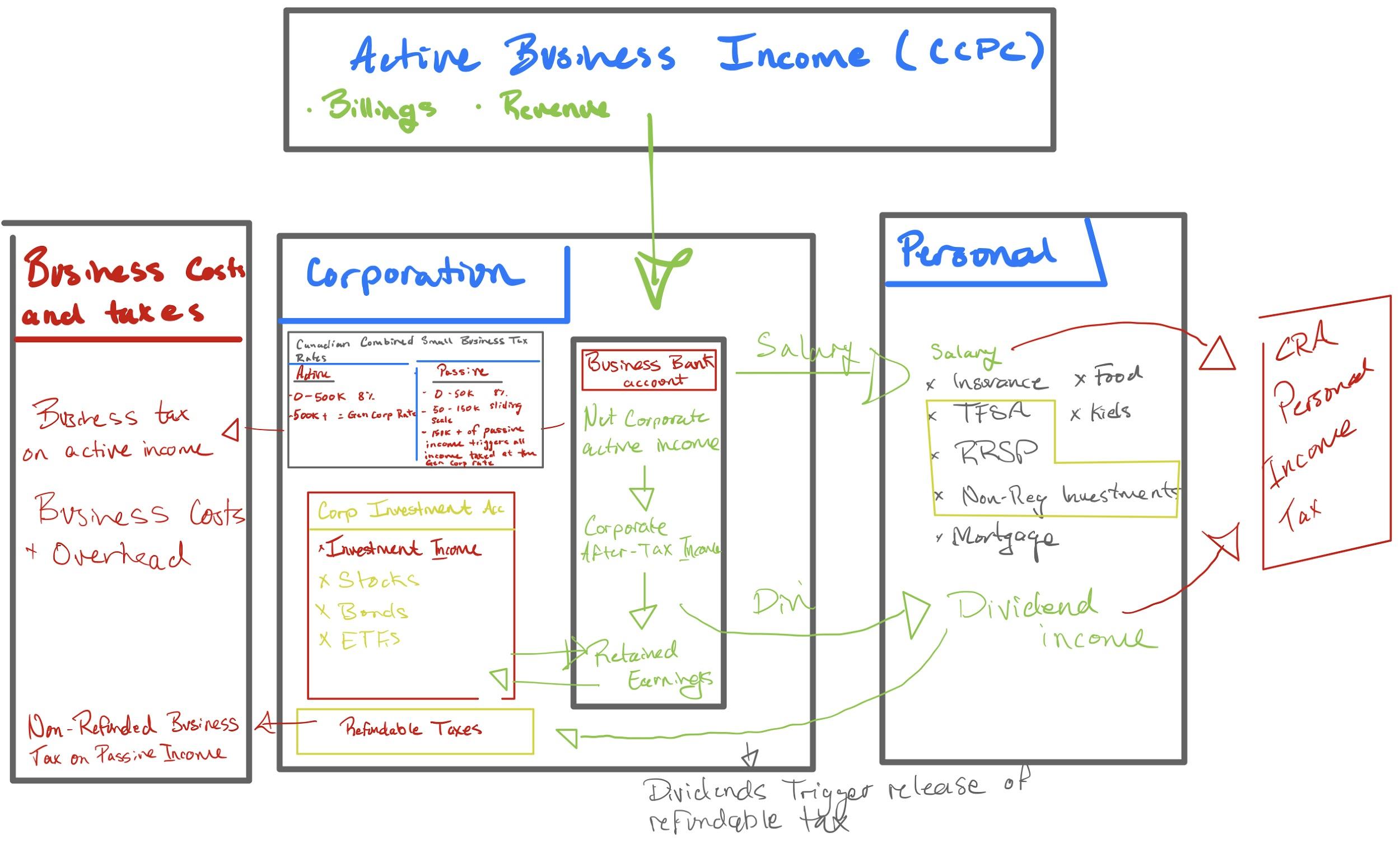

5. Understanding Your Tax Rate

Transitioning from 50-80k/yr to a self-employed high-income professional comes with new challenges. Massive personal income comes with massive personal income tax rates. There is a laddered scale to keep in mind as you manage your financial life.

Incorporated – You will be paying yourself from your corp to yourself personally. In this case, you will need to pay personal tax to CRA through your corporate payroll every month.

That would make the balance owing at tax time close to neutral. However, this doesn’t include the amount that will be owing when you pay yourself dividends.

Understanding what to do with Excess in the Corporation – Remember that for you to spend it personally, it needs to find its way into your hands. That means paying personal income tax on it. You will likely be flowing more money through your corporation to pay for your spending and debt reduction than you did as a resident.

6. Don’t Rush to Incorporate

UNLESS IT MAKES SENSE

Simply flowing money through a corporation does not save you money. In fact, it costs you. (see above)

Accounting for a sole proprietorship will run you about $1000-$ 3500/yr depending on who you use legal and accounting costs to set up a corporation, ongoing accounting, college, and legal fees can be in the $3 -7K/yr range depending on who you go with and how much of the legwork you do yourself.

The Tax-Deferral Advantage of A Corporation – The main benefit we tell our clients of a corporation is when you are saving more money than you could put into their RRSP and TFSAs. Due to the long training and high costs of becoming a doctor. Physicians need to save way more money in a shorter time than the average Canadian to save for retirement. This can easily overwhelm the space in TFSAs and RRSPs. Investing via a professional corporation can be an important tool to address the constrained savings problem.

Income Splitting – The other big benefit to incorporating is if you have a lower income spouse who will legitimately work >20h/wk for your practice. That opens the door to income-splitting to reduce taxes by using dividends. You can pay your spouse a “reasonable” salary for work done for your practice whether you are incorporated or not. In fact, having your lower-income spouse as your billing agent is great on many levels.

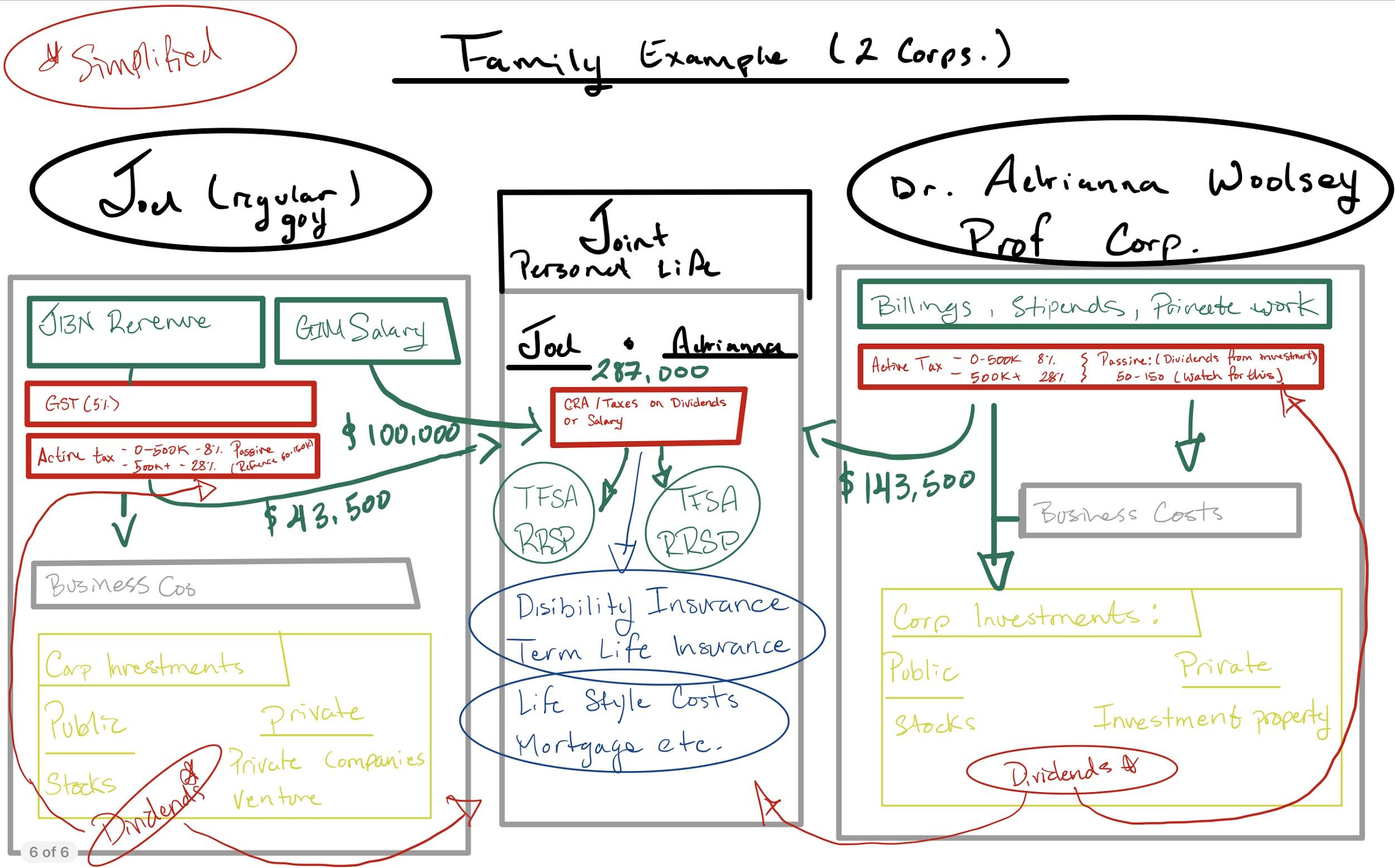

A double-doctor/ High Income couple dilemma – If there is a high-income doctor married to a drastically lower-income doctor, then a single corp could be used to income split with dividends to the lower income spouse. For couples with two big incomes or a high savings rate, it can be better to have two separate corporations. You need your trusty financial team to help you with this one.

Since incorporation is mainly beneficial when you are saving substantially, you may want to delay that until you are saving money.

That avoids the higher costs until they are offset by savings. Most of our clients starting out will take several years to build up a revenue-generating practice and pay off debt. For my family (Joel) it took us 18 months of practice to get to this point.

7. Insurance

Just like your personal insurance, it is important to consider your business insurance. Canadian Physicians are fortunate in that they have CMPA for their malpractice insurance needs. However, other aspects of doing business can become a financial hazard.

Disability Insurance –If incorporated, you could hold some disability insurance via your corporation to cover office overhead obligations. This insurance type often doesn’t kick in for a predetermined amount of time. So, oftentimes it’s advisable to have an emergency funding plan which can be Cash, or a LOC.

Malpractice Insurance – we recommend that you update this to reflect your current practice and pay the appropriate premiums. It’s not advisable to work without this coverage. Also, make sure that you understand if it covers you for unusual practices. For example, treating foreign self-pay elective patients.

Office/Clinic Insurance – House insurance for the clinic. This is intended to cover losses from damage to the building or equipment and revenue loss in the event of a pandemic, flood etc.

Whole and Universal Life Insurance – As a young attending, the most cost efficient way to cover for your death is personally held “term” life insurance.

In cases where you become or are very wealth, trigger the passive income in your corp or expect to have assets you need to protect in estate planning – whole/universal life is a useful financial tool. Do not rush into it without contacting a financial professional such as your accountant and financial team.